Effective carrier contract negotiation requires leveraging your own invoice data as a strategic weapon before entering the negotiation room. Contract optimization typically reduces shipping costs by 15-30%, but only when shippers close the “Execution Gap” between negotiated rates and actual invoiced amounts.

According to industry analysis, accessorial charges now represent 20-35% of total shipping spend, making surcharge negotiation as important as base rate negotiation in 2026. The shippers who achieve the deepest savings are those who audit their freight invoices first, identify where carriers are overcharging, and use that data to negotiate with specificity rather than hope.

Key Takeaways

- Contract optimization typically reduces shipping costs by 15-30% when backed by invoice audit data

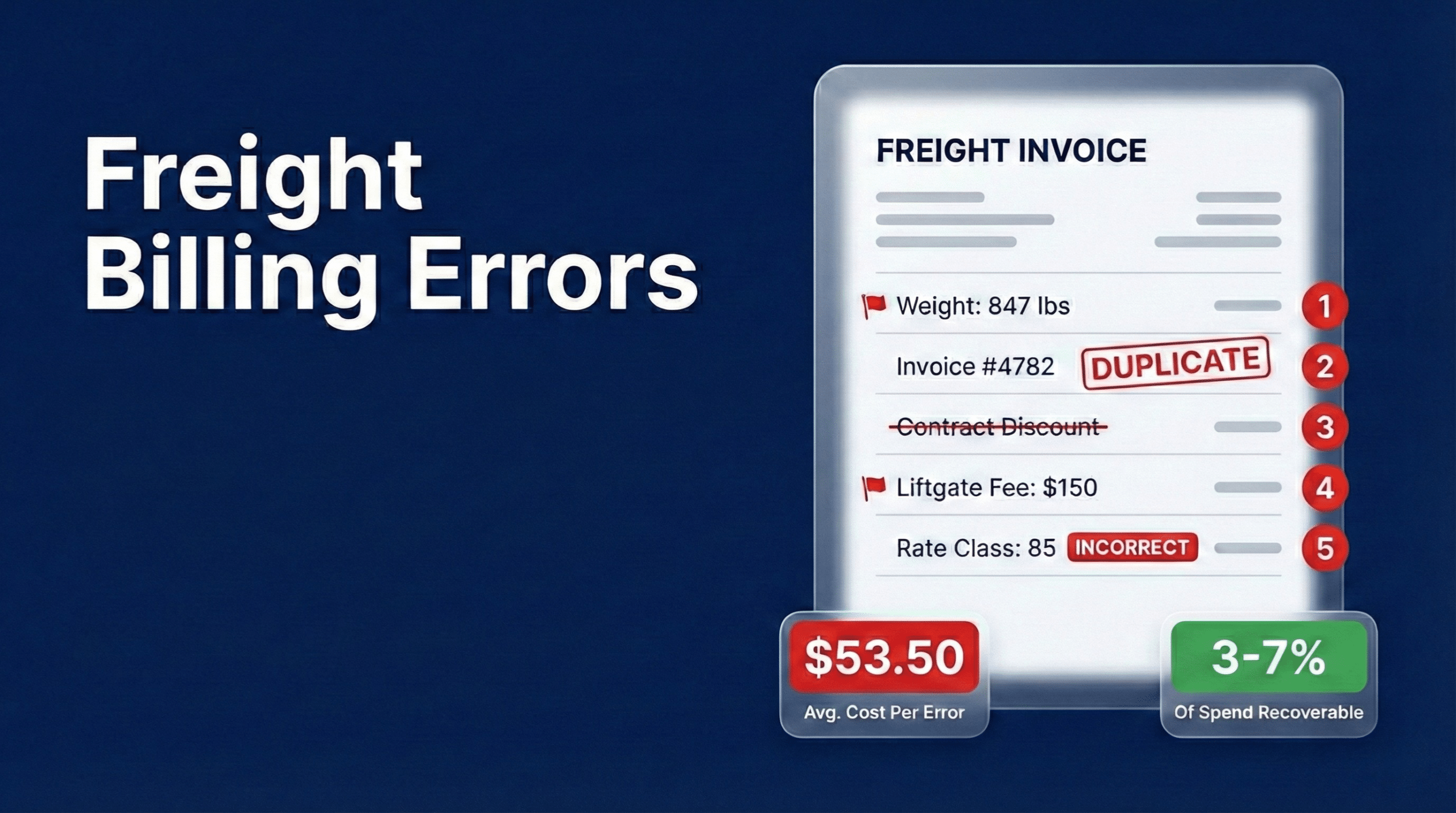

- The “Execution Gap” between negotiated rates and paid rates averages 5-15% due to billing errors, misapplied discounts, and surcharge proliferation

- Accessorial charges now represent 20-35% of total shipping spend, making surcharges the primary battleground in 2026 negotiations

- Starting renewal discussions 6-12 months in advance is critical because rushed negotiations favor carrier yield management

What is the Execution Gap in carrier contracts?

The Execution Gap is the difference between the rates you negotiated in your contract and the rates you actually pay on invoices. This gap, caused by billing errors, surcharge proliferation, and misapplied discounts, typically ranges from 5-15% of total transportation spend.

Most logistics directors believe they secured a competitive discount during their last negotiation. The contract states a 45% discount on ground shipments, so they assume that discount applies consistently. In reality, invoices tell a different story. Fuel surcharges calculated on a different base rate, residential fees that were supposed to be waived, dimensional weight charges using the wrong divisor: these line items erode the negotiated discount until the effective rate bears little resemblance to the contract rate.

Why do negotiated rates differ from invoiced rates?

Negotiated rates differ from invoiced rates because carrier billing systems apply charges based on complex rule sets that often interpret contract language narrowly or default to standard rates when exceptions are not explicitly coded.

Common causes include duplicate billing for the same shipment, incorrect weight or dimensional calculations, wrong service levels applied to packages, and surcharges not covered by your discount tiers. Carriers process millions of invoices daily, and their systems are optimized for yield management rather than shipper accuracy. Without automated auditing, these errors compound month after month.

How do you calculate your Execution Gap?

Calculate your Execution Gap using this formula: (Actual paid rate minus Contract rate) divided by Contract rate, multiplied by 100. This percentage reveals how much value is leaking from your negotiated agreement.

To perform this analysis, pull 12 months of invoice data and compare the billed amounts against what your contract specifies for each service type, zone, and weight break. Most shippers who complete this exercise discover their effective discount is 5-15 percentage points lower than their contract discount. That gap represents immediate recovery opportunity and negotiation leverage.

Why should you audit before you negotiate?

Auditing your freight invoices before negotiation reveals your true cost baseline, identifies leverage points carriers hope you miss, and provides the data needed to counter carrier proposals with specificity rather than generalities.

Carriers negotiate thousands of contracts annually. They possess sophisticated yield management software and deep data on lane densities, seasonal patterns, and market trends. A shipper who negotiates every two or three years enters this conversation at a significant information disadvantage. Audit data closes that gap. When you can demonstrate that a carrier’s billing accuracy rate on your account is 94%, or that fuel surcharges exceeded the contracted cap 37 times last quarter, the negotiation dynamic shifts. You are no longer asking for a better discount. You are presenting evidence that requires a response.

What data do you need before entering carrier negotiations?

You need 12-18 months of shipping history, zone distribution analysis, service mix breakdown, accessorial charge frequency by type, and billing error rates before entering carrier negotiations.

The extended timeframe accounts for seasonal anomalies that carriers will otherwise use against you. If your Q4 volume spike is your only leverage, carriers know your volume drops in Q1. But 18 months of data reveals your true shipping profile, including growth trends, service requirements, and the surcharges that hit your operation hardest. This comprehensive view enables targeted negotiation rather than broad discount requests.

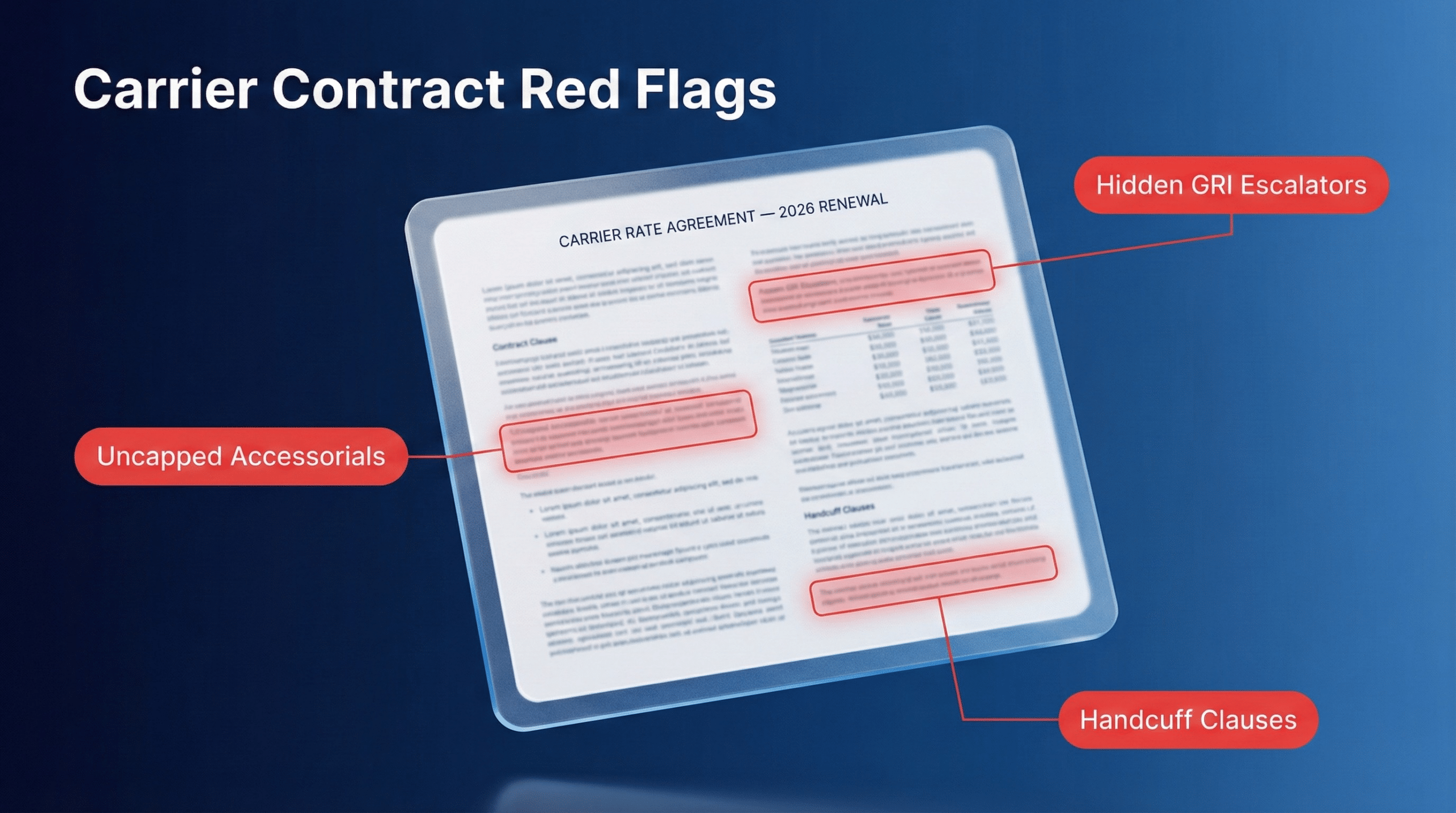

What contract terms matter most in 2026 negotiations?

The most impactful negotiation targets in 2026 are dimensional weight divisors, accessorial caps, tier protection clauses, and service guarantee terms. Carriers increasingly rely on surcharges rather than base rates to drive margin, making these line items more valuable than headline discounts.

The 5.9% General Rate Increase announced by FedEx and UPS tells only part of the story. Industry analysis indicates the realized cost increase for most shippers falls between 6% and 10% once surcharge adjustments are included. For shippers with Zone 7 and 8 concentration, effective increases often reach 8-12%, depending on shipping profile, due to rural area and large package surcharges.

| Contract Term | What It Controls | Typical Negotiable Range | Why It Matters in 2026 |

| DIM divisor | Billable weight calculation | 139 to 166 or higher | FedEx and UPS rounding changes (Aug 2025) increase billable weight |

| Fuel surcharge | Variable cost tied to fuel index | 10-50% discount off published table | Fuel tables reset annually, eroding prior gains |

| Residential surcharge | Per-package fee for home delivery | Waiver or 20-40% reduction | Fees now at $6.45-$6.95 per package in 2026 |

| Delivery area surcharge | Fee for rural or remote ZIP codes | ZIP code exemptions or caps | Remote area fees reaching $15-$17 per package |

| Tier protection | Discount preservation if volume drops | Minimum 12-month grace period | Prevents penalties during slow quarters |

How do dimensional weight divisors affect shipping costs?

A higher dimensional weight divisor reduces the billable weight of lightweight, bulky packages, often delivering more savings than a base rate discount for e-commerce and retail shippers.

The DIM divisor determines how carriers calculate billable weight for packages where size exceeds actual weight. Using a divisor of 139 (the UPS and FedEx standard) versus 166 can increase your billable weight by 19% on the same package. For shippers moving high volumes of lightweight goods, negotiating a higher divisor frequently outperforms a larger percentage discount on the base rate. This is especially critical following the August 18, 2025 rule change requiring any fraction of an inch to round up to the next whole inch, which both FedEx and UPS implemented simultaneously.

What are “handcuff clauses” and how do you avoid them?

Handcuff clauses are contract provisions that penalize shippers for reducing volume, such as revenue tier penalties that increase rates if spend drops below thresholds or early termination fees that create switching costs.

These clauses create the fear that moving 10% of volume to a regional carrier will trigger tier degradation, causing total costs to increase rather than decrease. The solution is modeling the break-even point before signing. Calculate whether regional carrier savings on diverted volume offset the tier penalty on retained volume. Then negotiate tier protection language that provides a 12-month grace period or graduated penalty schedules rather than cliff-edge drops.

How do you counter the 2026 General Rate Increase?

Counter the 2026 GRI by negotiating caps on specific surcharges, securing multi-year rate locks, and using simulation modeling to quantify the true impact before accepting any carrier proposal.

The headline 5.9% increase obscures significant variation by service type, zone, and package characteristics. Ground minimum charges have increased approximately 28% since 2022, rising from around $9.35 to $11.99. Zones 7 and 8 face above-average increases, as do common e-commerce package weights between 11 and 20 pounds. Effective counter-strategies target these specific pressure points rather than requesting broad discount improvements.

Request surcharge caps that limit annual accessorial increases to a fixed percentage. Negotiate fuel surcharge table modifications that use a more favorable index or discount tier. Build provisions requiring carrier notification 60 days before any off-cycle adjustments, which have become increasingly common as carriers move away from once-a-year pricing changes.

When should you start the contract renewal process?

Start the carrier contract renewal process 6-12 months before expiration to allow time for data analysis, competitive bidding, and multiple negotiation rounds without the time pressure that favors carrier yield management.

Rushed negotiations consistently produce inferior outcomes. When a contract expires in 30 days, the carrier knows the shipper cannot realistically switch. This eliminates the credible threat of competition that drives meaningful concessions.

A structured timeline begins with auditing and data gathering at 12 months out. At nine months, conduct simulated billing that re-rates your historical shipments against proposed new rates to reveal the true impact of term changes. At six months, issue RFPs to alternative carriers, including regional options, to establish competitive benchmarks. Enter active negotiation at three months with data, alternatives, and time on your side.

Frequently asked questions

How often should you renegotiate carrier contracts?

Most shippers should renegotiate carrier contracts every 12-24 months, or whenever shipping volume, service mix, or zone distribution changes significantly. Annual GRIs erode negotiated savings continuously, so even favorable contracts lose value over time. Triggering events like acquisitions, new distribution centers, or major product launches also warrant reopening negotiations.

What is the difference between published rates and contract rates?

Published rates are standard prices carriers advertise to all customers, while contract rates are negotiated discounts specific to your business. Contract rates typically range from 20% to 50% below published rates for mid-market shippers, with enterprise accounts sometimes achieving 60% or higher. The gap between published and contract rates represents your primary negotiation opportunity.

How do you offset General Rate Increases during negotiations?

Offset GRIs by negotiating surcharge caps that limit annual increases, securing multi-year agreements with escalation ceilings, requesting fuel surcharge table modifications, and building provisions requiring carrier notification before off-cycle adjustments. Focus on surcharges that hit your specific shipping profile hardest rather than broad discount requests.

What are the most negotiable accessorial charges in a freight contract?

The most negotiable accessorial charges include fuel surcharges (discount tiers or table modifications), residential delivery surcharges (waivers or caps), delivery area surcharges (ZIP code exemptions), additional handling fees (threshold adjustments), and dimensional weight divisors. These accessorials represent a significant portion of total spend for many shippers.

Do I need a freight audit to negotiate better rates?

Freight audit data significantly strengthens negotiation outcomes by revealing your true cost baseline, identifying billing error patterns, and providing benchmarks that counter carrier claims. Automated freight audits typically recover 3-7% of spend in errors while generating the data specificity needed for effective surcharge and discount negotiations.

Take control of your next carrier negotiation

The gap between what you negotiated and what you pay represents both a problem and an opportunity. Closing that gap requires data, and that data comes from systematic freight auditing. Before your next contract renewal, understand your true cost baseline, identify which surcharges hit your operation hardest, and enter the negotiation room with specificity rather than hope.

Request a free contract assessment from Zero Down’s analysts to benchmark your current carrier agreement against market rates and identify your top negotiation priorities.