Every month, businesses across America unknowingly overpay thousands of dollars on their shipping invoices due to UPS and FedEx billing errors. These mistakes aren’t isolated incidents; they’re systematic issues affecting millions of shipments annually. Industry analysis reveals that invoice errors frequently affect 5% or more of all carrier invoices, with annual overcharges potentially reaching tens or hundreds of thousands of dollars for midsize to large enterprises. The complexity of modern shipping operations, with dynamic pricing and constantly changing surcharges, has created a perfect storm for billing mistakes. This guide will walk you through the most common errors, explain why they occur, and provide practical strategies to identify, dispute, and prevent these costly mistakes.

Key Takeaways

- Up to 5% of UPS and FedEx invoices contain billing errors, costing businesses thousands monthly in overcharges.

- Common errors include incorrect fuel surcharges, duplicate charges, dimensional weight miscalculations, and unauthorized residential delivery fees.

- Address correction charges can cost over $20 per shipment due to invalid ZIP codes or formatting issues.

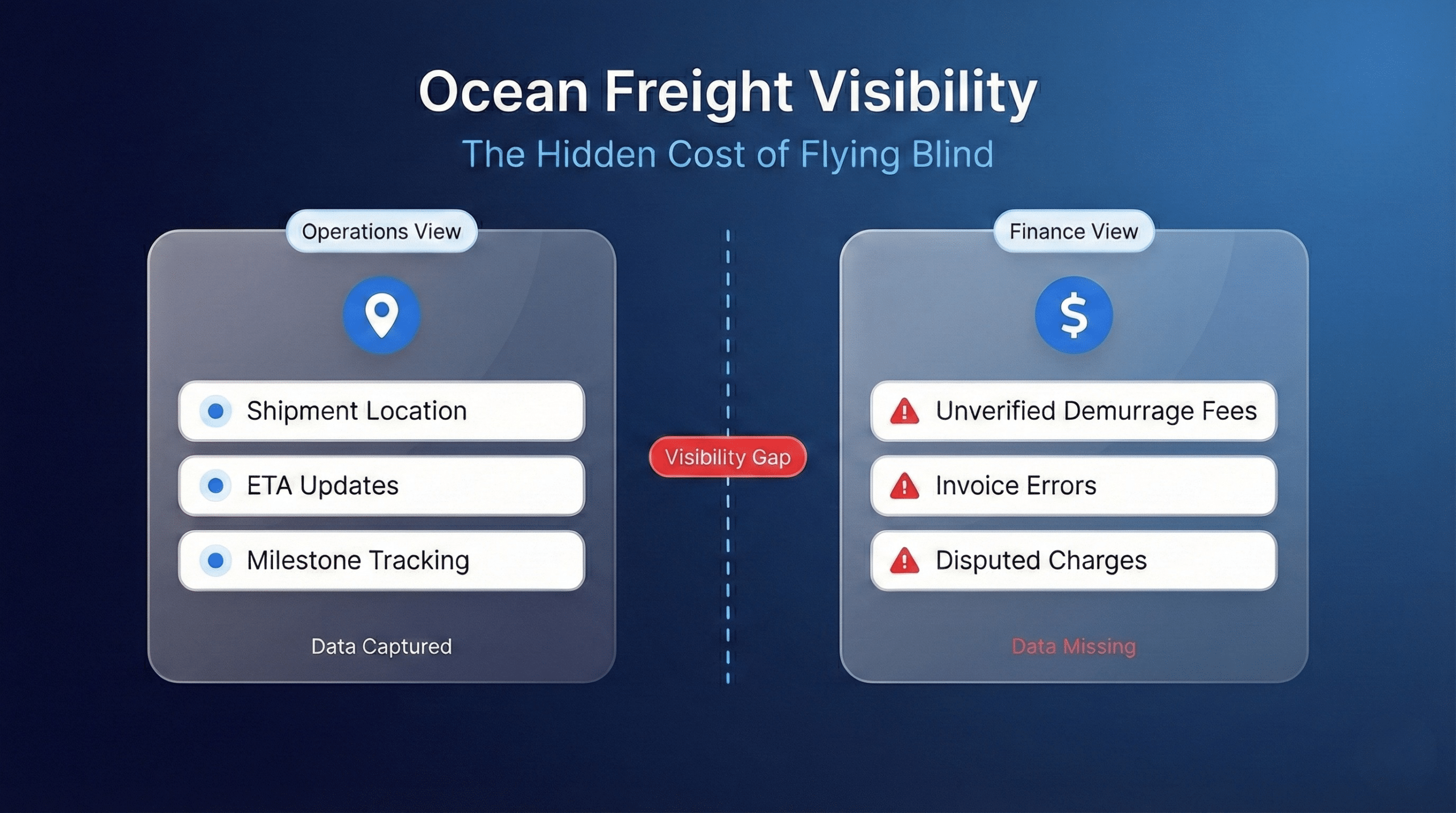

- Most businesses miss these errors because 70% rely on manual reviews that lack scale and pattern detection.

- Both carriers offer money-back guarantees and dispute processes, but claims must be filed within 30 days of the invoice date.

Most Common UPS and FedEx Invoice Errors

Understanding the specific types of billing errors that plague both FedEx and UPS invoices is crucial for effective auditing. These errors often follow predictable patterns, making them easier to identify once you know what to look for.

| Error Type | Common Cause | Potential Cost |

| Fuel Surcharge Errors | Outdated or incorrect rates applied to shipments. | 3-5% per shipment |

| Address Correction | Automated systems incorrectly flagging valid addresses. | Over $20 per shipment |

| Dimensional Weight | Incorrect package dimensions from scanning or data entry. | Varies; systematic overbilling |

| Duplicate Charges | Clerical errors or system glitches, billing a shipment twice. | Full cost of duplicate shipment |

| Residential Delivery Fees | Surcharges applied incorrectly to business addresses. | ~$5 per package |

| Outdated Contract Rates | New negotiated rates not applied in the billing system. | Difference between old and new rates |

Fuel Surcharge Errors

Fuel surcharges represent one of the most frequent sources of billing errors. Both carriers recalculate these surcharges frequently, sometimes weekly, based on market fuel price indices. However, outdated or incorrect rates are often applied to shipments, resulting in overcharges that can add 3-5% to each shipment’s cost.

Address Correction Charges

Address correction fees are among the most disputed charges on both FedEx and UPS invoices. These fees, which can exceed $20 per shipment, are triggered when carrier systems decide a shipping label has incomplete or incorrect address information. The problem often occurs when automated tools incorrectly flag valid addresses due to formatting discrepancies or ZIP code validation errors.

Dimensional Weight Miscalculations

Both carriers use dimensional (DIM) weight pricing, charging based on package volume rather than actual weight. Invoice errors frequently occur when incorrect package dimensions are recorded, either through scanning inaccuracies or data entry mistakes, leading to systematic overbilling.

Duplicate Charges

Duplicate charges are a straightforward error where the same shipment or service is billed multiple times. The causes range from clerical errors and data synchronization failures to glitches in carrier billing systems.

Incorrect Residential Delivery Fees

Residential delivery surcharges apply to packages delivered to home addresses instead of commercial locations. However, billing mistakes frequently occur when these surcharges are applied to legitimate business addresses, particularly for companies operating from home offices or mixed-use buildings.

Delivery Area Surcharges

Extended delivery area surcharges apply to shipments going to remote or hard-to-reach locations. These charges are sometimes incorrectly applied to standard delivery zones due to ZIP code database errors or system misconfiguration.

Outdated Contract Rates

Perhaps the most financially damaging error involves carriers billing at old rates instead of applying current negotiated pricing. This typically happens when contract rate updates don’t properly propagate through billing systems, leaving customers paying higher rates than agreed upon.

Why Invoice Errors Occur Frequently

The persistent nature of billing errors stems from several systemic factors that create ongoing challenges for accurate invoicing.

Complex Pricing Structures

Modern shipping pricing involves intricate calculations that factor in weight, dimensions, destination zones, service levels, and numerous surcharges. This complexity creates many points where calculation errors can occur.

Automated System and Scanning Limitations

While automation has improved billing speed, it has also introduced new types of mistakes. Automated systems depend on accurate data from multiple sources; if any component has outdated information, errors propagate to invoices. Similarly, scanners don’t always capture precise dimensions for irregular packages, often defaulting to estimates that result in higher charges.

Address Validation Failures

Address correction charges are a significant source of carrier revenue. The validation algorithms used by shipping services often err on the side of flagging addresses as problematic, generating correction fees, but creating frustration for customers with valid addresses.

Service Code Mismatches

A disconnect between shipping software and billing systems can create service-level errors where packages are processed at one service level but billed at another, resulting in customers paying for services they didn’t receive.

Contract Rate Implementation Delays

Delays or errors in applying newly negotiated contracts to carrier billing systems can result in customers being overcharged at old, higher rates.

Financial Impact of Billing Errors

The cumulative effect of seemingly minor billing errors creates a substantial financial impact. Understanding these costs helps justify the resources required for effective invoice auditing.

Cost Accumulation Patterns

Individual billing errors might seem insignificant, but they accumulate rapidly. A business shipping 100 packages per week with a 5% error rate could face nearly $4,000 in annual overcharges. For larger operations processing 1,000 packages weekly, this scales to nearly $40,000.

Real-World Examples

E-commerce businesses frequently discover systematic overbilling during comprehensive audits. One documented retail case revealed over $50,000 in annual charges from incorrectly coded shipment surcharges. Similarly, third-party logistics providers regularly identify address correction fees as a major source of recoverable overcharges.

Long-Term Impact on Profitability

For businesses on thin margins, a 3% increase in shipping expenses from billing errors can eliminate profitability. Beyond direct costs, these errors compromise business intelligence, as inaccurate cost data leads to suboptimal decisions about carrier selection and pricing.

How to Identify Invoice Errors

Effective error detection requires systematic approaches that go beyond a casual invoice review. Most mistakes aren’t immediately obvious and require a careful comparison between invoiced charges and shipment details.

A Step-by-Step Guide to Manual Invoice Review

A consistent manual review is foundational to error detection. Go beyond checking totals and systematically examine each invoice section. Start by comparing base charges against your shipping records, then focus weekly on these common problem areas:

- Weight and Dimension Verification: Cross-reference billed weights and dimensions against your shipping records, focusing on packages where dimensional weight pricing applies.

- Service Level Matching: Verify that billed service levels match what you selected in your shipping software.

- Fuel Surcharge Verification: Check fuel surcharge percentages against published carrier rate tables for the applicable time period.

- Address Correction Validation: Review all address correction charges to ensure the original addresses were truly invalid.

- Surcharges and Fees: Examine all surcharges line by line, paying special attention to residential and extended delivery area fees.

Red Flags and Warning Signs

Certain patterns indicate a higher probability of billing errors. Unusually high address correction volumes, inconsistent fuel surcharge percentages, and duplicate tracking numbers are all red flags that demand immediate attention.

Tracking Delivery Performance

Monitoring delivery dates against promised service levels helps identify failures that qualify for money-back guarantees. Use tracking information to document late deliveries, then check invoices to verify whether appropriate credits were applied, as they are rarely issued automatically.

Carrier Online Tools

Carrier portals like UPS Billing Center and FedEx Billing Online offer detailed invoices, but their format makes it difficult to spot systematic errors or patterns.

Automated Audit Software Benefits

For businesses with substantial shipping volume, automated audit software offers capabilities that manual processes cannot match. These systems cross-reference every invoice line item against shipping history, address databases, and rate tables at scale, excelling at pattern recognition.

Filing Disputes and Claims

Both UPS and FedEx have formal dispute processes, but success depends on understanding the specific requirements and deadlines.

UPS Dispute Process

UPS handles disputes through the UPS Billing Center, which provides online tools for submitting claims. The process requires specific documentation, including invoice and tracking numbers, plus a detailed explanation of the charge.

FedEx Dispute Process

FedEx Billing Online is the primary platform for disputes. Success depends on providing clear documentation, including air waybill numbers and invoice references, to support your claim.

Required Documentation

Successful dispute resolution requires comprehensive documentation. For fuel surcharge disputes, provide evidence of the correct rates. For service level disputes, show what was requested versus what was billed. For late delivery claims, tracking information is the necessary proof.

Filing Deadlines and Response Times

Both carriers impose strict deadlines for filing disputes, typically 30 days from the invoice date. Missing this deadline generally results in automatic denial of a claim, regardless of its validity.

Money-Back Guarantee Claims

Both carriers offer service guarantees, providing refunds for late deliveries. However, these refunds are not automatic; customers must identify the late deliveries and file specific claims.

Refund Processing and Tracking

Approved disputes typically result in credits on future invoices rather than direct refunds. Track these credits to ensure they appear correctly and cover the full disputed amount.

Preventing Future Invoice Errors

Proactive prevention strategies reduce the likelihood of billing errors and minimize the time spent on disputes.

Address Validation Implementation

Implement address validation tools in your shipping process to reduce address correction charges. Many shipping software platforms include built-in validation that flags potential issues before packages ship.

Accurate Measurement Protocols

Establish standardized procedures for measuring and weighing packages to ensure accurate data. Invest in quality scales and measuring tools, and train staff on proper techniques.

Contract Rate Monitoring

Regularly verify that billed rates match your negotiated contract terms. Schedule quarterly reviews with carrier representatives to confirm that all rates and discounts are properly implemented.

Shipping Software Integration

Utilize shipping software with built-in error detection capabilities. Configure your software to automatically apply your negotiated rates, which provides an additional verification layer.

Monthly Reconciliation Procedures

Implement monthly reconciliation processes that compare total shipping expenses against budgeted amounts. Track key metrics like average cost per shipment and surcharge frequency to signal emerging billing issues.

Staff Training Programs

Train shipping staff on proper procedures for address entry, package measurement, and service level selection. Educated staff can be the first line of defense against billing errors.

Third-Party Audit Services

For businesses with substantial shipping volumes, professional audit services provide specialized expertise and resources that often justify their cost through recovered overcharges.

When to Consider Professional Services

Professional audit services become cost-effective when shipping expenses exceed approximately $10,000 monthly. Businesses processing hundreds of shipments weekly often lack the time and expertise required for comprehensive auditing.

Cost, Benefits, and Recovery Rates

Most audit services operate on contingency fees, typically retaining 15-30% of recovered overcharges. Industry data suggests that professional services recover 2-8% of total shipping spend for most clients.

Impact on Carrier Relationships

Professional auditing, when done correctly, rarely damages carrier relationships. Carriers view disputes as a normal part of business and recognize the importance of accurate billing.

FAQ

How long do I have to dispute a UPS or FedEx invoice error?

Both carriers impose a 30-day deadline from the invoice date. This strict timeline makes regular invoice review essential, as waiting for quarterly or annual audits often means missing the dispute window.

Will using a third-party audit service damage my relationship with UPS or FedEx?

No. When conducted professionally, carriers view auditing as a normal business practice. They recognize that accurate billing is mutually beneficial.

What happens to refunds from disputed charges?

Approved disputes typically result in credits applied to future carrier invoices rather than direct cash refunds. These credits appear as line items on subsequent invoices, reducing your total amount due.

Can I still pay my invoices by credit card if I’m disputing charges?

Yes, disputing charges doesn’t affect your ability to pay invoices by credit card. Most businesses pay the full invoice amount while disputes are pending and receive credits on future invoices for approved claims.

Are there blackout periods when money-back guarantees don’t apply?

Yes, both carriers suspend service guarantees during specific periods like peak holiday seasons and severe weather events. Additionally, certain service types don’t include time-definite guarantees. Understanding these limitations helps identify which late deliveries legitimately qualify for refunds.