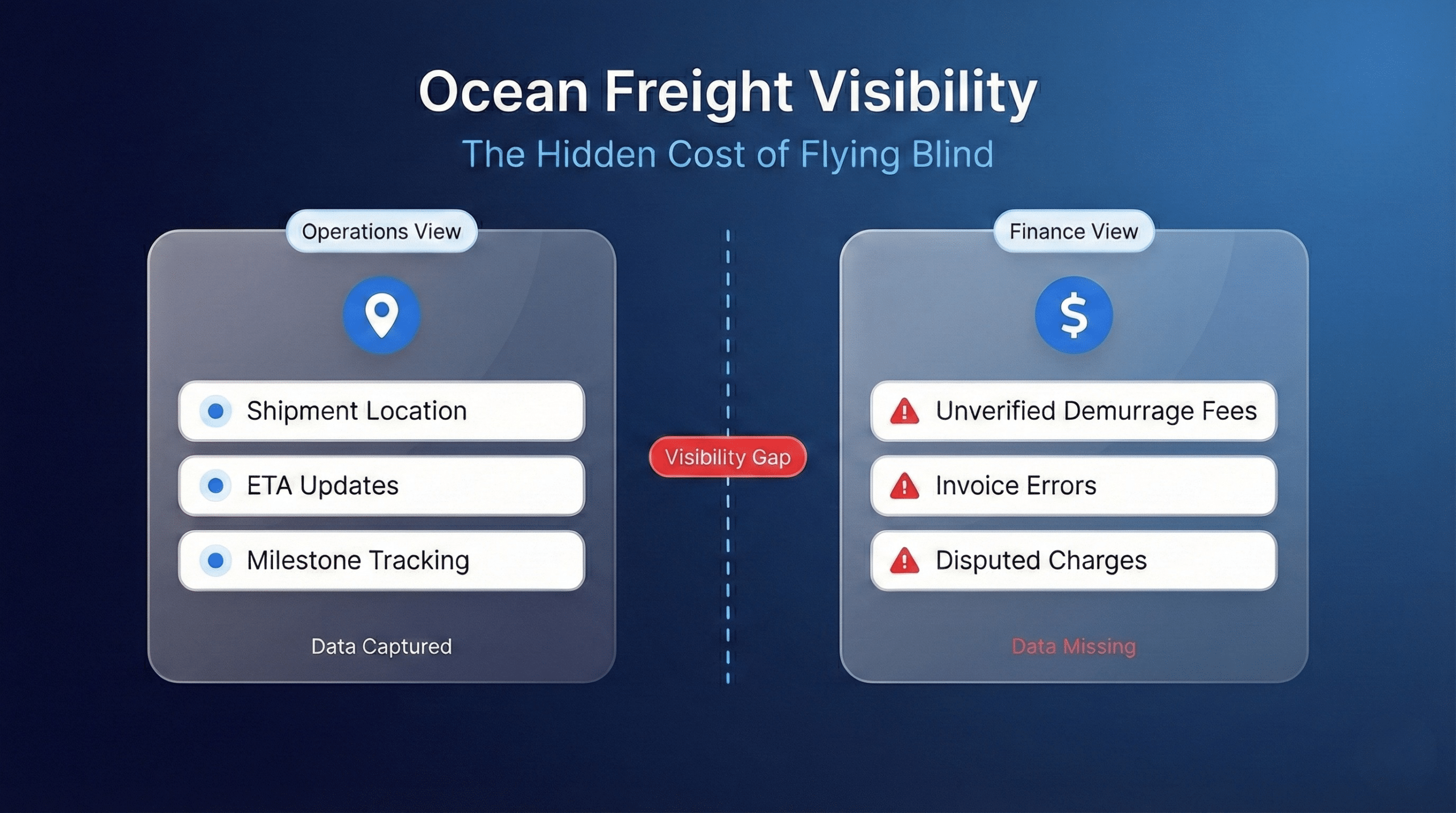

Why is ocean freight tracking failing to protect your bottom line?

Ocean freight tracking tells you where your container is. It rarely tells you what that location costs. With global schedule reliability hovering at just 51.5% according to Sea-Intelligence’s February 2025 Global Liner Performance Report, nearly half of all ocean shipments arrive late.

The real problem isn’t the delay itself. It’s that most shippers lack the visibility infrastructure to connect tracking data to financial outcomes: disputed demurrage charges, unaudited accessorial fees, and invoice errors that compound across thousands of shipments annually. This disconnect between operational tracking and financial tracking is the visibility gap.

Key Takeaways:

- Ocean schedule reliability sits at approximately 51.5%, meaning nearly 1 in 2 containers arrives late (Sea-Intelligence, February 2025)

- 64% of CPOs prioritize visibility for risk mitigation, but 57% say siloed data blocks execution (Deloitte, 2025)

- The visibility gap exists between operational tracking (where is it?) and financial tracking (what does this cost?)

- Effective ocean freight tracking must connect to freight audit systems to prevent revenue leakage from demurrage, detention, and invoice errors

What is ocean freight tracking, and why does it matter?

Ocean freight tracking monitors the physical location and status of containers as they move from the origin port to the destination. It matters because tracking data, when connected to financial systems, determines whether you pay accurate freight invoices or absorb hidden overcharges.

Most tracking relies on three data sources: AIS (Automatic Identification System) signals broadcast from vessels, carrier EDI feeds that update container status at key milestones, and port terminal data showing discharge and availability. The quality and timeliness of these sources vary significantly.

What’s the difference between vessel tracking and container tracking?

Vessel tracking shows ship location on a map. Container tracking shows your specific cargo’s status within that vessel and through port handling. This distinction matters for invoice auditing because financial milestones (when surcharges apply, when detention clocks start) depend on container-level events, not vessel position.

Carrier portals typically provide basic container status but update infrequently. Independent visibility platforms aggregate multiple data sources for higher accuracy, though blind spots remain during transshipment when containers transfer between vessels.

What is the ocean freight visibility gap?

The visibility gap is the disconnect between knowing where a container is located and understanding the financial implications of that location. Most tracking tools show a dot on a map without connecting that data to demurrage clocks, invoice validation, or landed cost calculations.

According to Deloitte’s 2025 Global Chief Procurement Officer Survey, 64% of CPOs identified “enabling greater visibility” as their top risk mitigation strategy. Yet 57% cited “siloed ways of working” as the main barrier. Tracking data sits in logistics systems while finance teams process invoices separately, with no automated validation between them.

How does the “arrival vs. availability” problem increase detention costs?

The arrival versus availability gap catches many shippers off guard. Actual Time of Arrival (ATA) means the ship docked. Availability means your container is discharged, cleared, and ready for pickup. These events can be separated by days.

Demurrage and detention fees often start accruing at availability, not arrival. Without visibility into this specific milestone, shippers miss dispute windows and pay charges they could have contested. Basic tracking tools rarely distinguish between these critical timestamps.

What are the hidden costs of poor ocean visibility?

Poor ocean visibility creates three categories of financial leakage: unauditable invoices due to missing milestone data, preventable demurrage and detention charges, and misallocated risk mitigation budgets.

Gartner’s May 2025 Supply Chain Symposium revealed that 82% of supply chain leaders admitted their proactive risk budgets targeted the “wrong risks” due to poor predictive data. They had tracking information, but it wasn’t financialized or connected to decision-making systems.

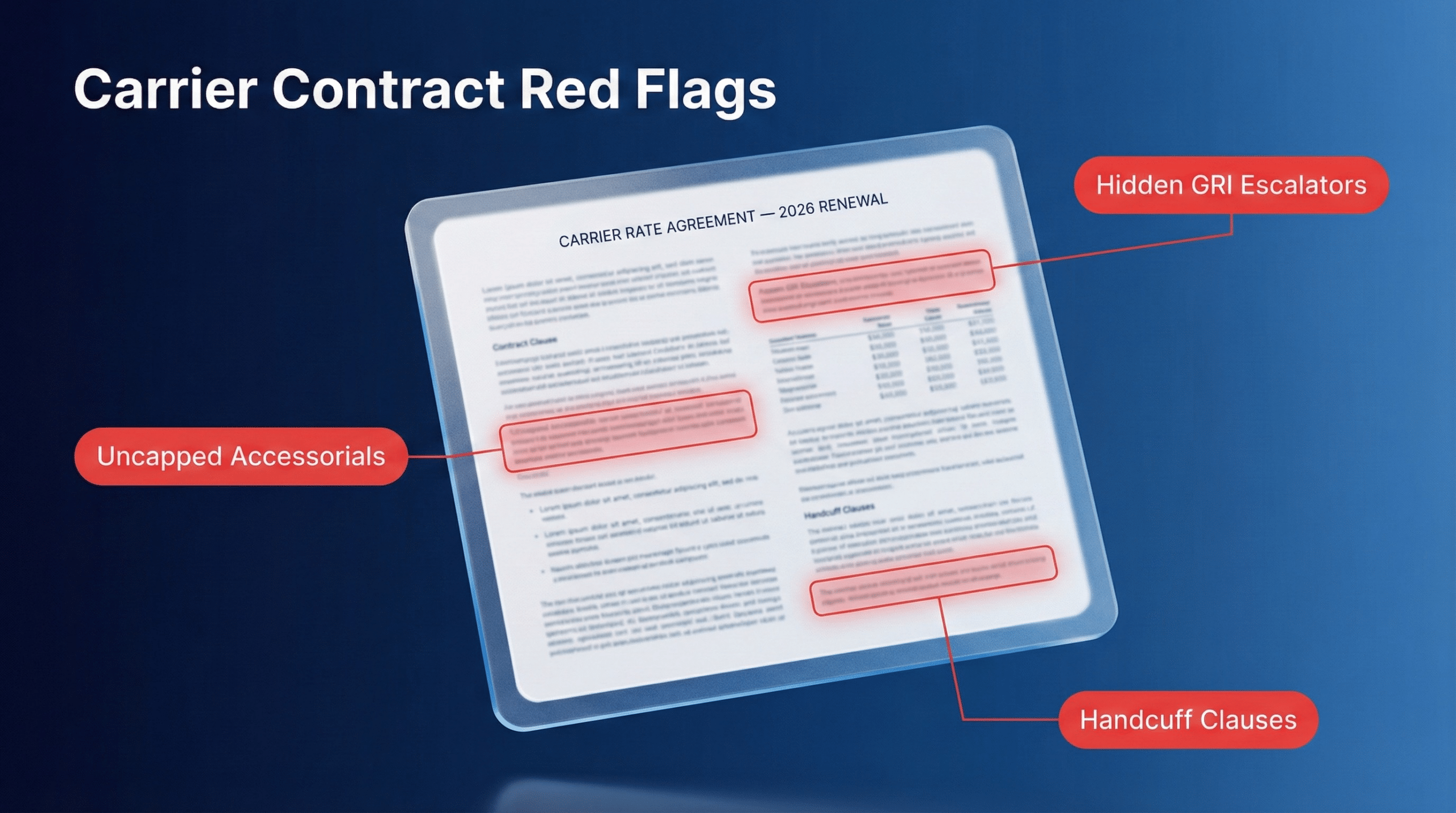

How does missing milestone data cause invoice errors?

Freight invoices include date-dependent surcharges for peak season, fuel adjustments, and port congestion fees. Without verified timestamps from independent visibility tools, you cannot audit whether the billed surcharge matches the actual shipment date.

Consider a container that was supposed to depart during a peak season surcharge window but actually left three days later when rates dropped. Without milestone verification, you pay the higher rate. Across thousands of shipments, these errors compound into significant overpayment.

What is the “Black Hole” of transshipment?

Transshipment creates a visibility blind spot when containers transfer from the mother vessel to the feeder vessel at intermediate ports. During this handoff, tracking often goes dark for 24 to 72 hours.

This gap creates exposure for freight claims when cargo is damaged or delayed during the transfer. It also makes invoice auditing difficult because you cannot verify whether delays occurred during ocean transit or during the transshipment process, which affects liability and dispute options.

Why can’t most shippers pass disruption costs to customers?

McKinsey’s December 2025 Supply Chain Risk Pulse Survey found that less than 20% of companies could pass more than 80% of supply chain disruption costs to customers. The remaining costs erode margins directly.

Without real-time visibility to pivot inventory before costs spike, shippers absorb financial hits they could have avoided. The Shanghai Containerized Freight Index averaged 2,496 points in 2024, a 149% increase over 2023, according to UNCTAD’s Review of Maritime Transport 2025. Rate volatility at this scale demands visibility that connects to financial decision-making, not just operational awareness.

How do you evaluate ocean freight tracking solutions?

Evaluate tracking solutions on three criteria: data granularity (container-level, not just vessel-level), milestone specificity (availability timestamps, not just arrival), and financial integration (direct feeds to audit and payment systems).

The question isn’t whether you need visibility. It’s whether your visibility connects to financial outcomes or just shows dots on a map.

| Evaluation Criteria | Basic Tracking (Carrier Portals) | Standalone Visibility Platforms | Audit-Integrated Visibility |

| Vessel location | Yes | Yes | Yes |

| Container-level status | Limited | Yes | Yes |

| Availability timestamp | Rarely | Sometimes | Yes |

| Carrier performance scoring | No | Yes | Yes, with cost-to-serve data |

| Invoice validation integration | No | No | Yes |

| Demurrage dispute support | No | Alerts only | Historical data for disputes |

| Typical cost | Free | $30,000-$100,000/year | Included in audit services |

How do you connect tracking data to freight audit?

Connecting tracking data to automated freight audit requires milestone-level timestamps that validate invoice charges, API integration between visibility tools and payment systems, and workflows that flag discrepancies before invoices are paid.

Critical milestones for invoice accuracy include actual departure date (determines rate applicability), transshipment timestamps (affects liability windows), actual arrival and container availability (triggers detention calculations), and gate-out time (confirms free time usage).

Can visibility data help dispute past demurrage charges?

Historical visibility data can void demurrage and detention charges by proving circumstances outside your control. AIS logs showing port congestion, terminal system records documenting discharge delays, or weather data confirming berth unavailability all provide evidence for disputes.

Most shippers only think about visibility for future shipments. The audit opportunity lies in using historical data to recover costs already incurred. A transportation management system (TMS) that archives this data creates an audit trail for dispute resolution.

Frequently asked questions about ocean freight tracking

How can I track my container using a Bill of Lading number?

Most carriers offer online portals where you enter your Bill of Lading (BoL) number to view container status. However, carrier portals typically show limited milestones and update less frequently than independent visibility platforms that aggregate AIS data and port feeds for more comprehensive tracking.

Are shipping containers equipped with real-time GPS monitoring?

Most standard shipping containers do not have built-in GPS. Tracking relies on AIS signals from vessels, carrier EDI updates, and port terminal data. Some shippers attach IoT devices for container-level GPS on high-value or temperature-sensitive cargo, but this adds cost.

How accurate is ocean freight tracking data?

Accuracy varies significantly by source. Carrier-provided data may lag 12 to 24 hours. Independent visibility platforms using AIS and multi-source aggregation achieve higher accuracy but face blind spots during transshipment. No single source is perfect, which is why financial validation requires multiple data inputs.

Why is my container tracking status not updating?

Common causes include transshipment between vessels, port congestion delaying terminal scans, or carrier system delays. If the status hasn’t updated in 48 hours or more, contact your carrier directly. Document the gap in case it affects demurrage calculations or dispute timelines.

What is the difference between vessel tracking and container tracking?

Vessel tracking shows the ship location. Container tracking shows your specific container’s status through port handling, discharge, and availability. For financial audit purposes, container-level visibility with milestone timestamps is essential because invoices are billed at the container level.

How can visibility data help reduce freight costs?

Visibility data enables cost reduction by validating invoice accuracy, identifying carriers with hidden cost-to-serve problems, and providing documentation for demurrage disputes. Shippers who connect visibility to audit workflows typically reduce freight costs by 2 to 5% through error correction alone.

How do you close the visibility gap?

Ocean freight tracking has become table stakes. Every carrier offers a portal, and dozens of visibility platforms promise real-time container positioning. The differentiator isn’t whether you can see your container on a map. It’s whether that visibility connects to financial outcomes.

The gap between operational visibility and financial visibility represents millions in unaudited spend for enterprise shippers. Closing it requires tracking systems that capture the right milestones, integration that feeds data into audit workflows, and processes that validate invoices before payment.

Zero Down connects ocean visibility data directly to freight audit workflows, validating invoices against actual milestones and recovering costs that basic tracking tools miss. Request a freight spend analysis to see how audit-integrated visibility protects your bottom line.