The FedEx 2026 GRI represents another year of sustained rate pressures for shippers as FedEx implements a 5.9% average rate increase effective January 5, 2026. This percentage increase matches the previous year’s adjustment, maintaining consistent upward pressure on shipping costs across the carrier’s network.

The implementation follows a two-phase approach. Base rate adjustments and most surcharge increases take effect January 5, 2026. Subsequently, certain changes to surcharge assessment criteria, such as for the Additional Handling and Oversize charges, will take effect on January 12, 2026. This staggered timing affects services like FedEx Ground, FedEx Home Delivery, and FedEx International services.

Key Takeaways

- FedEx implements a 5.9% average General Rate Increase (GRI) for list rates effective January 5, 2026.

- Most surcharge increases also take effect on January 5, while key changes to the assessment criteria for some fees begin January 12.

- Shippers can expect significant increases to residential and delivery area surcharges, impacting e-commerce and last-mile costs.

- Long-distance shipments (e.g., Zones 7 and 8) and common e-commerce package weights will likely see above-average rate hikes.

- The true cost increase for many shippers will exceed the 5.9% average due to the compounding effect of multiple surcharges, depending heavily on their specific shipping profile.

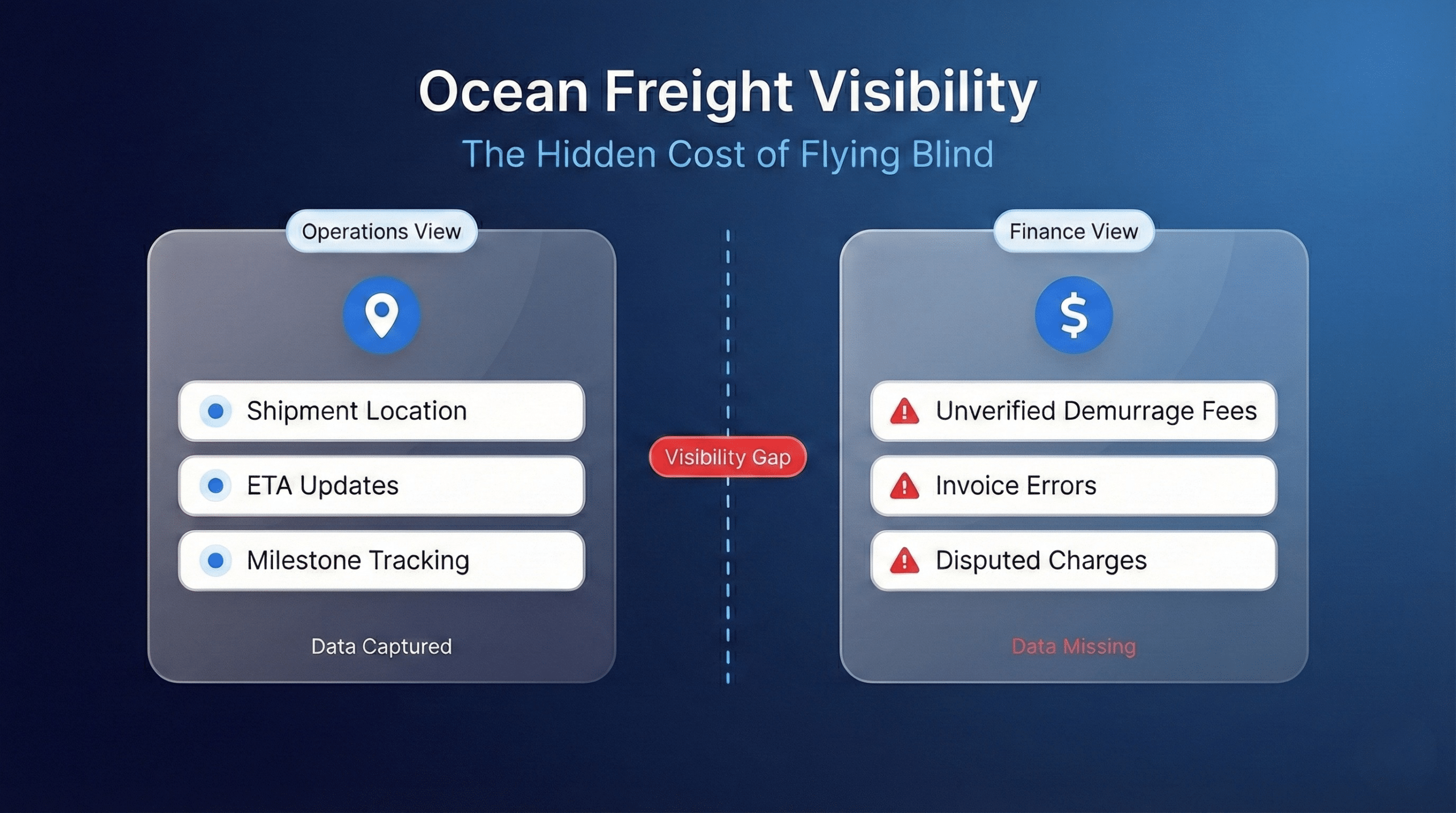

While the headline number suggests a manageable cost increase, the actual impact varies dramatically based on shipping zones, package characteristics, service requirements, and contract terms. Companies shipping to longer zones or relying heavily on residential delivery will face significantly higher impacts than the average suggests.

The 2026 adjustments align closely with UPS pricing strategies, maintaining the traditional competitive balance between the two carriers. Regional carriers continue to exert pressure in specific markets, but FedEx’s clear strategy focuses on enhancing yield through targeted increases rather than across-the-board adjustments.

Rate and Surcharge Summary

| Rate/Surcharge Type | Increase | Key Impact |

| Average GRI | 5.9% | Headline list rate; actual cost impact varies significantly. |

| Residential Surcharge | Significant Increase | Disproportionately affects e-commerce shippers. |

| Zone 7 & 8 Shipments | Above-average increases expected | Higher costs for long-distance shipping. |

| Middle-Weight (11-20 lbs) | Above-average increases expected | Affects common e-commerce package profiles. |

| Ground Minimum Charge | Increasing | Impacts lightweight, short-distance shipments. |

Service-Specific Rate Changes

- FedEx Ground: Experiences the baseline 5.9% average list rate increase, with higher effective adjustments in specific weight brackets and zones.

- Home Delivery: Sees significant changes, including per-package cost adjustments for services like Evening Home Delivery that compound with residential surcharges.

- International Services: Face complex adjustments. FedEx International Premium and Ground rates will vary by destination and weight. Import services will also see adjustments to clearance entry and U.S. inbound processing fees.

- Express Freight: Maintains premium pricing with targeted increases in certain weight brackets.

Surcharge Increases and New Fees

- Residential Surcharge: Increases significantly for both ground and home delivery services, heavily impacting e-commerce shippers.

- Delivery Area Surcharges: Modified for shipments to rural and less-dense ZIP codes, compounding costs for businesses serving extended delivery areas.

- Additional Handling Surcharge: Restructured with a new cubic volume criterion (effective Jan. 12), potentially capturing more lightweight shipments that previously avoided this fee.

- Fuel Surcharges: Maintain their variable structure, but assessment criteria changes will affect how they are applied.

- Clearance and Inbound Fees: Adjustments to fees such as the U.S. Inbound Processing Fee will add to the total landed cost for international shippers.

Zone-Based Pricing Impacts

Zone-specific rate adjustments reveal the true complexity of the FedEx 2026 GRI impact. Shipments traveling to zones 7 and 8 are expected to face above-average increases, significantly exceeding the headline 5.9% figure and altering the economics of cross-country shipping.

The market shaped by regional carriers creates competitive pressure in specific geographic areas, but FedEx’s strategy focuses on premium pricing for extended delivery zones where alternative options remain limited. Companies with national distribution networks face difficult decisions about service levels and cost structures for distant customers.

Businesses shipping large volumes to specific zones may discover that their effective rate often increases by double or triple the advertised percentage. This zone-based pricing strategy reflects FedEx’s approach to enhance yield in markets where operational costs continue rising faster than average inflation rates.

The FedEx Ground minimum charge, which is increasing, affects shorter zones differently by creating a floor that many negotiated discounts cannot penetrate. This particularly impacts many lightweight shipments traveling shorter distances.

Weight-Based Rate Adjustments

Weight-specific targeting creates disproportionate impacts across different shipping profiles. Middle-weight packages, common in e-commerce, are expected to face above-average rate increases. This weight range captures a large portion of shipping volume, meaning many companies may discover their actual cost increases substantially exceed budgeted amounts.

The increase to the FedEx Ground minimum charge affects many businesses shipping lightweight items. This minimum charge impacts small packages regardless of negotiated discount levels, creating a floor that nullifies discounts for many shipments.

Heavy-weight shipments experience different dynamics, where volume shippers often maintain better negotiating positions. However, the weight and dimension criteria changes for additional handling and oversize charges create new exposure for packages that previously avoided these ancillary fees.

Specific weight brackets in certain zones see increases that challenge traditional shipping strategies. Companies will find that their specific shipping profile determines the actual impact far more than the headline percentage suggests.

New Assessment Criteria and Uncertainty Factors

January 12, 2026, brings the implementation of revised assessment criteria for additional handling and oversize charges, creating planning challenges for many shippers. The new cubic volume criterion and expanded weight parameters remain partially undefined in public documents, preventing precise budget forecasting until the new service guide is released or invoices reflect the changes.

This uncertainty factor complicates strategic planning for businesses trying to model their 2026 shipping costs. The lack of specific dimensional and weight thresholds means companies cannot accurately predict which shipments will trigger new surcharge categories.

Shippers must plan contingency strategies to address these unknown surcharge impacts. The limited advance detail creates significant budgeting challenges, and conservative cost projections may prove inadequate once the new criteria take full effect.

The complexity of overlapping criteria changes affects different package types unpredictably. Companies shipping products with specific dimensional characteristics face particular uncertainty about how new assessment criteria will impact their total shipping costs.

Shipper Type Impact Analysis

- E-commerce shippers face compounding impacts from multiple rate adjustments that target their typical shipping patterns. The combination of residential surcharge increases, weight-based adjustments for common package sizes, and delivery area surcharge modifications creates a significant cost burden that can substantially increase their effective rate.

- High-volume shippers experience margin erosion despite negotiated discounts that typically offset some base rate increases. The strategic nature of surcharge increases means that volume alone cannot protect against the full cost impact, as many surcharges apply regardless of shipping volume or discount levels.

- Small businesses encounter particular challenges from the FedEx Ground minimum charge increase, where lightweight shipments lose the protection of negotiated discounts. These businesses often ship packages under 5 pounds, where the minimum charge increase represents their primary cost impact.

- International shippers manage combined pressures from base rate increases, surcharge adjustments, and clearance fee increases that affect their total landed costs. Companies managing supply chain operations across borders face complex cost modeling challenges.

Different shipper profiles require tailored strategies to address their specific exposure patterns. E-commerce businesses focusing on residential delivery need different approaches than B2B shippers serving commercial addresses, while international operations face unique combinations of rate and fee increases.

FAQ

When do the FedEx 2026 rate increases take effect, and are there different dates for different changes?

FedEx implements the 2026 rate changes in two phases: base rate increases and most surcharge increases take effect January 5, 2026. Certain modifications, particularly to the assessment criteria for surcharges like Additional Handling and Oversize, begin January 12, 2026. Shippers will need to analyze their invoices carefully after both dates to see the full impact.

How can shippers calculate their actual cost increase since it varies from the 5.9% average?

Calculating the actual cost increase requires a detailed analysis of your specific shipping profile, including zones, weights, service usage, and surcharge exposure. While the base rate increase is 5.9%, factors like significant residential surcharge increases and above-average hikes for long-distance zones mean the final impact will be different for every shipper. Depending on these factors, the effective increase for some shippers could plausibly fall in the 8-12% range, but this will vary widely.

What are the new Additional Handling and Oversize criteria that start January 12, 2026?

FedEx is implementing a new cubic volume criterion and expanded weight/dimension parameters for these charges. However, the specific thresholds have not been fully detailed in advance public announcements. These changes will affect how packages are assessed for these surcharges, potentially capturing shipments that previously avoided them. Shippers should consult the 2026 FedEx Service Guide when available and monitor their invoices to understand the impact.

Which surcharges are increasing the most, and how do they compound with base rate increases?

The residential surcharge is seeing a significant increase, well above the 5.9% average GRI. Delivery area surcharges and additional handling fees are also increasing. These surcharges compound with base rate increases because they are applied as separate line items, meaning a shipment faces both the zone-based rate increase and the surcharge increase simultaneously, resulting in a total cost increase well above the headline percentage.

How do FedEx’s 2026 rate increases compare to UPS and other major carriers?

FedEx’s 5.9% average increase aligns closely with UPS’s traditional pricing strategy, maintaining competitive parity. Both carriers typically announce similar headline percentages. However, the real story lies in service-specific and surcharge increases, where carriers differentiate their strategies. Regional carriers continue to pressure both FedEx and UPS in specific markets, but the major carriers focus on yield enhancement rather than volume competition through their pricing strategies.